عرض العناصر حسب علامة : فيروس كورونا

هل أنت مستعد لإعادة صياغة العمليات لتحقيق المرونة والاستدامة؟

يقوم مديرو العمليات الذين يتعاملون مع تعقيدات عالم متغير ومتقلب بإعادة بناء عملياتهم من الألف إلى الياء لتزدهر في المستقبل.

معلومات إضافية

-

المحتوى بالإنجليزية

COOs navigating the complexities of a changed and volatile world are rebuilding their operations from the ground up to thrive in the future.

Three questions to ask

How are you turning your supply chain into an agile supply network?

Are you ready for the data and technology risks that come with connected operations?

How does the workforce fit into your plans for resilient and sustainable operations?

Until recently chief operating officers (COOs) have focused primarily on fine-tuning the value chain for speed to market, efficiency and profitability. But the world has changed — at first gradually and now suddenly. Over the last several years, empowered consumers, employees and investors, climate change, geopolitics and technology innovations have disrupted organizations, pushing them to change how they operate. Over the last 18 months, the COVID-19 pandemic turned that slow push into a giant, forceful shove. And COOs have had to figure out on the fly how to operate in this changed environment.

Organizations may still be making the same products and services, but everything about how these products and services are designed, manufactured and delivered to customers is different. This shift is forcing COOs to reimagine their supply chains for agility and sustainability as much as optimization. Across the enterprise, technology innovations are helping COOs transform how the business operates to meet multiple, simultaneous demands from a range of stakeholders — and increasing the chances of cyber infection. Reskilling and upskilling the workforce can help accelerate digital transformations and address cyber risks. And all this in the global context of economic and techno-nationalism.

To navigate this increasingly complex and volatile world, COOs need to reframe their future for operational resilience and sustainability.

Low angle view of lighthouse by rocky mountain against sky1

Chapter 1

Resiliency begins with visibility

Leading COOs are making the leap from linear supply chains to agile networked ecosystems.

How EY can help

Supply Chain Transformation

Consulting at EY can turn your supply chain transformation ambitions into reality through the power of people, technology and innovation. Find out more.

Read more

Operational resilience begins with the value chain. As a leading COO, you need to transform your organization’s rigid, linear value chain into an agile, networked ecosystem. There are three areas to prioritize for measurable results.

1. Create real-time, end-to-end visibility

Today’s technology allows you to cost-effectively build a virtual model of your physical end-to-end supply chain. Known as a digital twin, this virtual model gathers and connects data from various sources and systems across the supply chain network to create a virtual replica, containing the same supply entities, parameters and financial targets. Leveraging digital twins paired with simulation capability, you can then use control towers to make data-driven decisions using real-time data, improving agility in both sensing and responding to disruptions. With the accelerated speed of disruption today, simulations need to be repeated and acted upon continuously to manage the risks.

2. Develop resilient and sustainable sourcing

Resilient and sustainable decision-making relies on constantly finding the right sourcing balance. Diversity of sources can help maintain competitiveness. However, over-diversification can limit your ability to develop trusted relationships with suppliers. At the same time, vendor and geographic concentration could leave you vulnerable to disruptions such as vendor insolvency or civil unrest. Today’s volatile and ESG-focused environment demands prioritizing trusted partnerships and ecosystems to mitigate risk, improve operational assurance, and support sustainable strategies.

To know who to trust and where the risks are, you need a sourcing strategy that maps and tracks suppliers, facilities and products down to raw materials. This approach will help to improve operational transparency and traceability, and allow analysis of supplier compliance, KPIs and supply chain risks.

3. Build omni-capable networks

Delivering products and services when, where and how customers expect them requires agility and the right capabilities. This may mean fulfilling a customer’s need faster and cost-effectively from a store rather than a distribution center if it’s closer and has the inventory. Building the right distributed order management (DOM) capabilities coupled with digital control towers for Tier N visibility can help maximize the value of inventory through accuracy and visibility, positioning it where it’s most needed.

Windmills on field against sky2

Chapter 2

Net-zero operations provide net positive business benefits

Leading COOs see stakeholder demands for improved ESG performance as more than a compliance exercise.

Related article

Why net-zero supply chains are the next big opportunity for business

Why net-zero supply chains are the next big opportunity…

Focusing on sustainability encourages you to rethink your business for the f…

2 Aug 2021 Velislava Ivanova

Value chains also hold the key to sustainable operations. Many organizations have committed to or have ambitions to decarbonize their operations through net-zero targets. Leading COOs have three ways to turn what is often seen as a compliance exercise into a new source of competitive advantage and an important driver of transformation.

1. Decarbonize the value chain

Efforts to decarbonize the value chain begin by assessing your organization’s carbon footprint — as well as the carbon footprint of every partner and supplier in your ecosystem. In doing so, you can identify ways to reduce greenhouse gas emissions, set emissions reduction goals, prepare reporting and improve rating scores against global guidelines. Real-time visibility, quantification and traceability of data throughout your extended operations are prerequisites for this kind of assessment and action — as is a clear business case to support it. However, the benefits of improving ESG performance across the entire value chain are clear: enhanced processes, lower costs, increased productivity, innovation, differentiation and improved societal outcomes.

2. Build circular product lifecycles

In addition to your decarbonization efforts, as the COO, you’ll want to take the lead in working with other business units to design products for a second life, or that can be recycled or repurposed. To engage in the circular economy, you’ll need to implement circular operating models with closed material loops. As always, gathering data along the value chain and conducting analyses are critical to identify circular market opportunities.

3. Embrace tax planning

Tax penalties and incentives are playing a key role in driving sustainability initiatives globally. Work closely with the tax leader to align the organization’s tax profile with your operational footprint. You may decide, for example, based on tax implications, to relocate heavy-emitting operations to jurisdictions where tax penalties are lower or incentives are higher. However, in doing so, you will need to balance the benefit of relocating with potential downside implications, such as transfer pricing adjustments that may not be favorable, or the reputational risk of moving emissions rather than reducing them. By teaming with tax, you can help to reduce the impact of carbon taxes, while taking full advantage of sustainability incentives — with a particular focus on circular supply chains.

Low angle view of industry against clear sky3

Chapter 3

Tech and data ecosystems balance rewards and risks

Opening operations to better, faster decision-making also increases third-party risks and cyber attacks.

A suite of new technology tools — intelligent automation, data and analytics, internet of things (IoT), cloud — are helping COOs gather real-time data, sense and measure current reality, and predict and act in near real time. Used to maximum effect, these tools can help you build agile supply networks and elevate business performance across the enterprise.

Many COOs undertaking digital transformations to incorporate these new tools continue to make decisions using statistics, intuition and experience. As a COO, you need to be making decisions that are predictive and data-driven. But with this expanded potential comes increased risk. Data-driven decisions require petabytes of data. As a result, you may be integrating third-party technologies and acquiring third-party data to better anticipate customer needs, build networked supply chains that can manufacture personalized products, and innovate a new generation of logistics that can deliver products faster and more cost-effectively.

In the quest to gather as much first-party data as possible, you may also be more willing to open operations, networks and systems to wide-ranging connectivity, including areas that have never before been connected to the internet. The more connections an organization has — to systems, networks, suppliers, partners and ecosystems — the greater the risk of infection and attacks such as ransomware.

According to the EY Global Information Security Survey 2021, many organizations are still accustomed to a reactive cybersecurity mindset. As a COO, you must adopt a mindset of security by design. Security by design requires integrity analyses when the technology is acquired and then testing of the technology as it’s introduced into the organization. Cybersecurity is also easier to manage in a cloud environment than in a legacy environment. But the integrity of data in the cloud is only as good as the integrity of the third parties that supply it. Developing trust among third-party suppliers requires a change in governance and management operations.

You’ll also need to rethink the definition of workforce. It’s harder today to distinguish between a third-party provider, customer, employee and contractor. In this context, the workforce acts as a mechanism for propagating malicious code and a vulnerable point of attack by threat actors.

Pigeons flying in city4

Chapter 4

Resilient operations require a resilient workforce

Employees need to feel good about where they work and confident in their contribution.

Today’s supply chain and operations workforce needs to analyze data, identify outcomes and offer recommendations. This requires a digital fluency and familiarity with information and processes that may not come naturally to traditionally trained workers. In a recent EY survey, Reinventing the supply chain for an autonomous future, only 44% of respondents said their employees were prepared for digital innovation in the supply chain.

As a COO, knowing your people are at the center of any successful rebound strategy, you’ll want to work with the chief human resources officer (CHRO) to mix recruiting with upskilling, retooling and continuous improvement. Additionally, consider a redesign of your workforce to access capabilities across people, process, technology, analytics and metrics. This may include working with both the CHRO and the chief information security officer (CISO) to upskill employees to become “citizen developers.” This approach will have the advantage of gaining a combined skillset that blends IT skills with knowledge of the business. By working directly with the CISO and the cybersecurity team to nurture “citizen developers,” you also improve your function’s ability to better manage the rising torrent of cyber risks.

In addition to assisting in skills development, you’ll want to motivate your people by creating a purpose-led vision of the future. This includes a clear development path with performance incentives. You’ll want to work with the CHRO to design individual programs that support the health and well-being of each of your employees. These efforts provide employees with more confidence in what they do and more satisfaction about where they work.

4 تغييرات ستستمر في المحاسبة لفترة طويلة بعد انتهاء الوباء

لقد أثرت التأثيرات بعيدة المدى لوباء COVID-19 على كل صناعة في جميع أنحاء العالم، ولم يعد خبراء حماية البيئة محصنين.

معلومات إضافية

-

المحتوى بالإنجليزية

4 changes that will stick with accounting long after the pandemic is over

By Justin Hatch

October 12, 2021 3:24 PM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

The COVID-19 pandemic’s far-reaching effects have touched every industry around the world, and CPAs are not immune. Not only were CPA firms working to help the businesses they serve survive economic challenges, but they were fighting their own battles as well. According to one survey, approximately 90% of CPA firms reported concerns for their company, ranging from health to finances and operations. Despite the challenges, firms also reported facing the challenges with innovations like using cloud technology and innovation.

Necessity is the mother of invention — or in some cases, reinvention. The accounting industry was forced by COVID-19 to evolve almost overnight, and not all of the changes that occurred will be going away. Here are some of the adaptations that will be part of the industry going forward.

Adaptability

coronavirus-mask.jpgCPAs have learned to adapt quickly to changes in their work, whether it be major financial programs like the Paycheck Protection Program or adjusting the way they work with clients. Clients have come to expect continually up-to-date information from their CPA anytime they need it, and there will be no going back. Customers will expect their accountants to be able to come up with solutions at the drop of a hat, whether or not there is an international crisis.

Not only will customers continue to demand more agility from CPAs, but there will always be rapid changes that require accountants to think on their feet. CPAs stood tall when the challenge arose in 2020, and the pandemic only made them more able to face any new obstacles in the future.

Better communication

A lack of in-person interaction could be detrimental for some, but for CPAs, it may have actually been a boon. Trying to work remotely with clients forced CPAs to communicate more effectively. Cloud-based dashboards, video conference calls, chatting online, and sending frequent emails are the norm now, whereas both CPAs and clients may have been reluctant to give them a try before.

Clients couldn’t be left hanging during a pandemic that had major financial implications. They needed fast, insightful information about new programs and how they could help their business, and it was up to CPAs to stay on top of it all and boil it down for them. The result is CPAs who are better communicators for future clients as well.

Flexible work environment

COVID-19 brought about a sudden adjustment as workers moved from conference rooms to living rooms. Though many businesses, including CPA firms, later began bringing workers back, the office landscape has likely changed for good. More workers are staying in their home offices full time or choosing a hybrid option, with some working from home and some in the office. This shift not only affects the way a CPA firm runs internally but also how it will serve its clients — many of whom are shifting to more remote work as well.

CPAs and clients alike learned to work with each other from a distance, and that will add a level of flexibility going forward that will benefit everyone. Businesses will come to rely on their accountants outside of more traditional meetings and scheduled reports, and CPAs will be able to answer the bell from anywhere if needed.

Expanded services

The Paycheck Protection Program was a much-needed life preserver for struggling businesses in 2020, but the intricacies of the program were a lot to work through. Applications, required paperwork, loan forgiveness and other factors could make the program confusing for business owners. CPA firms reported expanding services to help businesses take advantage of the program, making up 39% of new services offered to clients.

Although this service was directly related to the pandemic, firms will continue to expand their offerings even after the pandemic is in the past. In a 2021 survey, 33% of firms reported they anticipated adding new services like financial advisory, cash flow and risk advisory in the next year.

Many of the changes brought on by COVID-19 were already in motion in the industry, but firms got the extra push they needed to move forward. Businesses have been seeking more advisory services from their CPAs for years, and many firms have begun to expand their offerings. The pandemic, and the severe economic impact it had across industries, helped move the transition along.

CPAs have fought alongside their clients through the COVID-19 pandemic, and their work has been vital to businesses’ success through the crisis. The lessons learned from the pandemic will have a long-lasting impact on the profession as CPAs continue to adapt and grow for the benefit of their clients.

المواقف المتميزة وسط الأزمة

في الوقت الذي لا يوجد فيه الكثير من الأخبار السارة في العالم للإبلاغ عنها، نحن متحمسون جدًا لأن نكون قادرين على القيام بذلك من خلال تقديم خبر "القادة الناشئين لعام 2021 لمجلة المدقق الداخلي".

معلومات إضافية

-

المحتوى بالإنجليزية

At a time when there’s not a lot of good news in the world to report, we are very excited to be able to do just that by introducing Internal Auditor magazine’s 2021 Emerging Leaders.

As we’re all well aware, working during a worldwide pandemic has introduced a host of new challenges for internal auditors, including remote work, travel restrictions, and communication issues, not to mention helping their organizations form COVID-19 response plans. This year’s Emerging Leaders have been required to address these and many other issues while continuing to add value in their daily work. And, as you will read in “Emerging Leaders: 2021,” they have done just that.

As Bill Mulcahy, longtime practitioner and IIA volunteer, explained in his nomination of honoree Christy Beers, “She handled the ultimate audit double dip — a large company merger while managing the changes that come with remote work during the pandemic.” Bill, who sadly passed away earlier this year, was one of Christy’s biggest advocates. “I’m grateful for having known him,” she told us. “I wouldn’t be where I am today without his mentorship.”

Bill was also a big advocate of Internal Auditor’s Emerging Leaders, nominating a young professional each year. Whenever one of his nominees was chosen, Bill would be sure to take out a full-page ad to congratulate him or her. We will greatly miss his dedication to, and enthusiasm for, advancing the next generation of internal auditors.

Bill’s 2021 nomination is one of 15 Emerging Leaders who hail from across the U.S. and five additional countries — The Bahamas, Canada, Ghana, United Arab Emirates, and Vietnam. Five men and 10 women from a variety of industries and backgrounds share their stories of success. From using virtual meetings and telehealth systems for virtual walk-throughs, to creating a collaborative onboarding portal and team intranet site, to creating new opportunities to be agents of change during the pandemic, their stories are diverse and impressive.

And speaking of impressive, beginning on page 41, we check in with some of our past Emerging Leaders. Whether they continue to rise through the ranks of internal auditing or are using their audit experience to move into a new profession, many of our past Leaders, as expected, continue to excel in their chosen career paths.

Hear more from past and current Emerging Leaders about just what it takes to be a leader in a series of videos on InternalAuditor.org.

Congratulations to our 2021 Emerging Leaders! You’ve persevered through a pandemic and are more prepared than ever to be leaders in your profession.

الدور الأساسي للمدراء الماليين في تعزيز الصحة العقلية للموظفين

بالنسبة للمحاسبين المهنيين، تزيد مشكلات الصحة العقلية من مخاطر عدم تحديد الأخطاء في التقارير المالية أو اكتشاف مؤشرات الاحتيال.

معلومات إضافية

-

المحتوى بالإنجليزية

The following is a contributed piece from Russell Guthrie, CFO of the International Federation of Accountants (IFAC). Opinions expressed are author's own.

The coronavirus pandemic has put a long-overdue spotlight on mental health. Clinical studies have found a strong correlation between pandemic-related anxiety and behaviors, such as hopelessness or substance abuse, that companies cannot afford to ignore. Implementing an organizational framework to support mental health is not only the right thing to do, it's smart for business. With the potential to alleviate human and financial costs, support for mental health should be seen as core to the finance function’s role in promoting sustainable value creation.

In 2019, the World Health Organization estimated that mental health issues cost the global economy upward of $1 trillion per year. In the wake of the past year, that cost is likely to increase considerably, reinforcing the need for mental health to be a key priority for employers and organizations worldwide.

Addressing mental health successfully, however, will require the involvement of the entire C-suite — not just HR, and not just the CEO. The finance function must be a pivotal part of the conversation both in supporting the adoption of company initiatives and in examining the cultural values of the accountancy and finance profession globally.

Long-term growth and value creation

Creating a culture of understanding must be a critical priority for CFOs. Failing to care for employees can mean falling behind as an organization, particularly in sectors where a company’s best asset is its human capital. A 2020 Gallup survey found that two-thirds of full-time workers polled were facing burnout at least some of the time, and those people were three times more likely to look for another job. It’s both more humane and more cost-effective to support your talent’s well-being rather than risk a mass exodus and face the high price of attrition — especially if you have developed a reputation for burning out your employees.

Russell Guthrie

Courtesy of IFAC

Effectively addressing mental health by establishing the appropriate infrastructure to support employees can also play a determinant role in attracting and acquiring new talent. According to a recent report by the International Federation of Accountants (IFAC) and the Association of Chartered Certified Accountants (ACCA), Generation Z — the group of 18-25-year-olds entering the workforce during the pandemic — cites mental wellbeing as a top priority when seeking employment.

CFOs must be advocates for the crucial relationship between employee mental health and a company’s bottom line. Fatigue, burnout and other signals of strained mental health stand in opposition to the creativity, collaboration and stamina required to stoke growth and resiliency within companies.

A unique threat

The finance function — and, more specifically, accountancy profession — is innately people-centered, relying on equal parts technical and non-technical capabilities. Professional accountants, in particular, are responsible for critically reviewing information and large sets of data to ensure accuracy and compliance with laws and regulations, as well as evaluating conflicts of interest — a job that demands mental acuity, attention to detail and good judgement. Unsurprisingly, when people are under mental strain, it is increasingly difficult to focus on the task at hand.

For a professional accountant this may heighten the risk of not identifying errors in financial reports or impact one’s ability to spot indicators of fraud, both of which can have far-reaching consequences. It’s not enough, however, to recognize what is at stake. Leaders have to promote a culture that will mitigate those risks.

By nature, the accountancy profession is built on the expectation of perfection. Working against a standard of excellence — with little room for error — professional accountants face numerous internal and external pressures. And particularly now, as the global economy recovers from the impacts of COVID-19, professional accountants are facing increasing stress as the institutions they support focus on rebuilding.

Such high expectations create an environment ripe for the deterioration of mental health. This, coupled with the general stigma surrounding mental health, often results in hesitation to recognize or address fatigue, depression, or any other mental health issues.

Mental health must be included among the tenets of ethical and good business performance. A robust financial system is the bedrock of any thriving economy, and the people who uphold the rigor of high-quality accounting have to be a top priority.

Building the infrastructure

Mental health must be considered part of an organization’s environmental, sustainability and governance (ESG) strategy and approached as would the provision of any other basic human right. Just as global standards are a critical vehicle for reaching sustainability goals, a similarly rigorous approach will help companies, both large and small, establish the necessary infrastructure to properly support employee well-being.

The right response will likely look different from region to region and from organization to organization, but the essential first step is simply making mental health part of the ongoing dialogue of the organization. From there, organizations must deploy initiatives for supporting employees and their ability to perform.

This will likely mean rethinking normalized processes to identify existing threats to well-being and potential barriers to care. For instance, some companies will need to reconsider the relentless focus managers place on productivity. Others will have to reevaluate insurance plans to consider coverage of mental health treatments. They should look to institute mental health literacy programs and leverage outside expert resources to empower employees to prioritize mental health and support those in their communities looking to do the same. Ultimately, leadership needs to be highly engaged in this effort. Successfully shifting corporate culture to prioritize mental well-being starts at the top.

While it’s not solely up to CFOs and the finance function to champion new and expanded norms for operating within the current reality, they are essential to creating a positive space to discuss and address employees’ mental health. It’s mission critical if we want to ensure businesses continue to operate as productively, sustainably, and ethically as possible.

برايس ووترهاوس كوبرز تضيف 100 ألف وظيفة!

تستثمر شركة برايس ووترهاوس كوبرز 12 مليار دولار عبر أعمالها العالمية في إصلاح شامل يستهدف عمليات تدقيق أفضل

معلومات إضافية

-

المحتوى بالإنجليزية

PwC to add 100K jobs in $12B strategic revamp

PricewaterhouseCoopers LLP is investing $12 billion across its global business in an overhaul targeting better audits, digitization of services and greener operations.

The professional-services provider will hire 100,000 employees and develop the skills of existing staff over the next five years as it seeks to respond to the post-pandemic operating environment, it said in an emailed statement on Tuesday.

“We will continue to evolve our ways of working, and expand our capabilities in the areas that matter most for the future, while remaining steadfast in our commitment to quality,” PwC Chairman Bob Moritz said. “We want our people to be the most sought after in the market.”

Auditors are grappling with managing quality amid a shift in ways of working introduced by the COVID-19 pandemic. The International Auditing and Assurance Standards Board has revised standards for auditors, coming into effect in 2022, to boost technology use, help manage new risks, and improve quality management.

PwC is also seeking ways to address growing calls for transparency in the profession from stakeholders after several accounting scandals among the Big Four auditing firms knocked public trust. In South Africa, for example, KPMG has put in place a variety of reforms after it came under fire in 2017 for work done for a politically connected family accused of plundering the government’s coffers.

The South African unit of PwC will add at least 2,500 new employees over the next five years, Chief Executive Officer in the region Dion Shango told reporters in a conference call. Across Africa, where it has a presence in 34 countries, the firm plans to bulk up its operations with a $400 million investment. The company is also interviewing for non-executive directors to strengthen audit oversight.

PwC has also set aside $3 billion of its total global investment to help double the scale of its Asia-Pacific operations, it said. The firm’s spending will also focus on responding to environmental, social and governance trends across its operations.

توقعات عن ارتفاع رسوم التدقيق بنسبة 62٪ هذا العام

معلومات إضافية

-

المحتوى بالإنجليزية

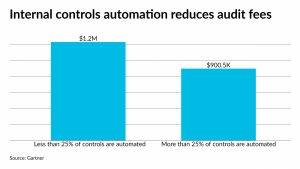

Clients anticipate that audit fees will increase in 2021 due to the impact of inflation, COVID-19, acquisitions and divestitures, according to a survey by Gartner.

The survey found that 62% of the companies polled are expecting audit fee increases this year, but that may be offset by technology savings. Organizations that automate at least 25% of their internal controls paid 27% lower audit fees on average, according to Gartner’s survey of 166 publicly traded and privately held companies. Of the respondents, 81% used a Big Four audit firm. Of the 166 organizations surveyed, Gartner analyzed 124 for the impact that internal controls automation had on the amount they ultimately paid in audit fees.

The survey revealed the steadily increasing amounts of audit fees, exacerbated by the inflationary pressures that have affected so many sectors of the economy this year as the U.S. and the rest of the world struggle to recover from the COVID-19 pandemic. The pandemic also accelerated the shift to technologies like remote audits over the past year, and the increasing use of automation for audits and internal controls as many auditors worked from home and away from their offices.

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. In comparison, companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average,” said Ashwani Gupta, director in the Gartner Finance practice, in a statement Tuesday. “The biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit. Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future."

Audit fee spiked the most last year in the banking and insurance sectors, with 69% of respondents in each category reporting increases. Financial services companies have more complex accounting processes and financial reporting exposures needing more auditor hours. Insurance companies also experienced some of the highest number of internal controls relative to companies in other industries.

On the other hand, the technology and telecom sector showed the lowest impact on fees, with only 41% of respondents reporting increases for 2020. The companies that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to the fees paid in 2019.

The main factors driving audit fee increases ranged from inflation to COVID-19 related, but organizations that negotiated on audit fees and made a strong case with their primary auditing firm were able to get a flat fee or a lower than expected audit fee increase. Of the respondents who attempted to negotiate their fees, 45% said their fees declined by over 6%, while half were able to cut their fees by between 3 to 6%.

ماذا يعني تجمُع المواهب العالمي للمحاسبين الإداريين؟

في 6 مايو من كل عام، يعترف أولئك الذين يعملون في مهنة التمويل بالمحاسبين الإداريين في جميع أنحاء العالم

معلومات إضافية

-

المحتوى بالإنجليزية

What a global talent pool means for management accountants

By Jeff Thomson

May 06, 2021, 9:39 a.m. EDT

3 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Each year on May 6, those of us in the finance profession recognize management accountants across the globe. This International Management Accounting Day is especially poignant, coming after one of the most disruptive and challenging years for businesses in modern history, and we should all take the time to appreciate the hard work, dedication and tenacity of those prevailing through the pandemic. Management accountants are risk managers, budgeters, strategists and decision-makers who are valued by their companies during uncertain times.

The crucial role of management accountants has not changed, but the global talent pool from which companies recruit them has undergone an immense transformation over the past year. Thanks to mass remote work, which will likely continue in some form once the pandemic is over, the job market is no longer local, regional or even national. With companies announcing office closures and hiring remote employees, talent no longer has borders. Eliminating geographic boundaries increases the number of applicants with whom candidates are competing, so it’s important they find ways to compellingly distinguish themselves. As a result, here is what should be top of mind for all management accountants today.

Prioritizing globally recognized certifications

Web Seminar Execute your data driven audit

The journey toward a fully data-driven audit that utilizes AI begins by first effectively leveraging automation and analytics in your audit workflow.

SPONSOR CONTENT FROM WOLTERS KLUWER

Accountants with globally recognized educational achievements will stand out among the rest. For nearly 50 years, the CMA (Certified Management Accountant) certification, a U.S.-based globally recognized certification offered by the Institute of Management Accountants, has been the global benchmark for the profession. It’s designed to meet the needs of a rapidly changing business environment. Top employers such as 3M, AT&T, Bank of America, Boeing, Hewlett-Packard, Johnson & Johnson, Microsoft, Procter & Gamble, Verizon and Xerox employ and promote CMAs. From Fortune 500 companies to small and medium-sized businesses, employers in every industry recognize their value.

AI as a trusted business partner

These uncertain times laid bare the advantage of companies that were more advanced in AI. The adoption of new technologies by organizations has significantly increased this past year to meet demands and exceed expectations. Proficiency with artificial intelligence, data analytics, robotic process automation and cloud-based computing at scale are real competitive differentiators around the world. Those equipped with these tech skills can not only automate processes and leverage data analytics, but also perform more value-adding work, making them highly attractive and putting them in high demand in today’s labor market.

The value of sustainability

Management accountants are vital to the financial health of organizations as they plan for business sustainability. Companies that operate in global markets are subject to a variety of environmental, social and governance (ESG) disclosure requirements. Accounting and finance professionals with a pulse on sustainability reporting have a leg up. They see how ESG issues, such as climate change preparedness and diversity, equity and inclusion tie into the growth of intangible business value. More importantly, today’s finance leaders drive their organization’s value in an unpredictable market.

Rethinking risk

The COVID-19 pandemic caused supply chains and business continuity plans to crumble. Now, accountants are increasingly being called upon to minimize risk and prepare for future disruptions. All organizations are susceptible to fraudulent activities, but their accounting and finance teams can identify, deter and report fraud risks. These professionals make critical decisions and implement effective risk oversight, solving problems and thinking outside the box to the benefit of their businesses.

On this International Management Accounting Day, it’s worth asking what competing in a global accounting and finance talent pool means for CMAs. At IMA, we’ve been tracking these shifts and prevailing trends relevant to management accountants and other finance leaders and professionals. We’re proud to see them continuously bringing their value, expertise and determination to their companies during these uncertain times. This is why we have a day out of the year earmarked just to celebrate them.

3 مفاتيح تقنية لتمكين المحاسبين

معلومات إضافية

-

المحتوى بالإنجليزية

3 tech keys for empowering accountants

By Clayton Weir

September 10, 2021 10:43 AM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Much like every business vertical, accounting has seen its fair share of disruption as a result of the COVID-19 pandemic. And although digital transformation efforts have pushed innovation forward in many industries, accountants, by and large, unfortunately have to deal with fractured processes and outdated tools from pre-pandemic times. Not only do accountants have to tackle daily tasks with antiquated technology, but they have to find ways to make this tech meet the modern demands of today’s financial industry. And as the world around them continues to evolve and modernize, accountants are understandably struggling to keep up.

With that in mind, it is time for banks to allocate more attention and resources toward revamping their accounting infrastructure. Here are a few areas in particular that they need to focus on in order to make this happen.

Cloud migration

technology-and-telecom.jpgWith the number of tools that accountants are forced to deal with on a daily basis, remote work is a nightmare for those who are still forced to work with on-premise infrastructure. Moreover, given a significant portion of the financial industry still relies heavily on this “traditional” technology, on-premise is one of the foremost hurdles that is holding accountants back today. That said, the fix is quite simple: adopt the cloud.

By leveraging a cloud-based infrastructure, businesses can immediately boost the efficiency of their accounting teams by giving them easy, instant access to the data and solutions they need from anywhere. Additionally, it can also make onboarding new tools and processes far less painstaking than doing so with on-premise legacy systems.

Embrace automation

With CFOs and accounting teams now expected to participate more fully in business strategy and other non-finance tasks, the amount of time these teams have to engage in manual tasks continues to shrink. And as such, calls for greater automation within finance departments continue to grow.

According to a guide produced by Sage, 93% of finance workers say they would be happy to have tech do their daily accounting tasks. In addition, as budgets remain tight and workforces are continuously expected to do more with less, empowering accounting teams with automation will be pivotal to business efficiency and overall success.

Choose fintechs wisely

No two finance departments are exactly the same. So it is imperative that businesses take a step back and consider their needs properly before adopting tools and processes. Sure, a tool might seem to make sense on the surface, but what if it actually complicates things or makes tasks more challenging? All too often businesses jump into the fintech pool without fully understanding what their needs are and what they need to solve them.

Accountants have incredibly full plates to begin with. And without the support infrastructure and tools they need to juggle these tasks, it is virtually impossible for them to keep up with modern demands. Therefore, businesses need to work in close consultation with finance teams to identify their most pressing needs and find the solutions that are best tailored to them. Granted, with a global remote workforce, this may seem like a daunting prospect. By getting all of their ducks in a row early, not only will businesses be able to make the onboarding process far easier for their accounting teams, but they will also save valuable time and money down the road.

Accountants are integral to helping businesses achieve financial success. And with that, the time has come for these teams to be supplied with the modern tools that their work deserves. Without it, accountants will continue to struggle to meet their full potential and will not be able to help businesses achieve the growth they are looking for.

زيادة إيرادات Deloitte العالمية إلى 50.2 مليار دولار

ذكرت شركة Deloitte أن إيراداتها العالمية نمت بنسبة 5.5٪ في السنة المالية المنتهية في 31 مايو 2021 لتصل إلى 50.2 مليار دولار حيث زادت الشركة قوتها العاملة بنسبة 3.2٪ إلى 345000.

معلومات إضافية

-

المحتوى بالإنجليزية

Deloitte global revenue increases to $50.2B

By Michael Cohn

September 09, 2021, 11:54 a.m. EDT

4 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Deloitte reported its global revenue grew 5.5% in the fiscal year ending May 31, 2021 to $50.2 billion as the firm increased its workforce 3.2% to 345,000.

Despite the challenges of the global pandemic, the firm grew its business, with financial advisory services growing at the fastest pace at 12.9%, followed by audit and assurance, which grew 6.1%. Risk advisory services revenue grew 5.6%. Consulting services grew 5%. Tax and legal revenue grew 2.3%.

Government and public services was the fastest-growing industry, followed by technology, media and telecommunications. Financial services clients contributed 27% of Deloitte's total revenue.

Deloitte Canadian office in OttawaBrent Lewin/Bloomberg

Among the different regions, the Asia Pacific region grew at the fastest rate at 14%, followed by the Europe, Middle East and Africa (EMEA) region, which grew 11.3%. Deloitte also expanded its global alliance and ecosystem business by 24%. The firm managed to adapt during the COVID-19 pandemic.

Start Preparing for CECL

The long awaited CECL standard is on its way. Is your financial institution ready?

PARTNER INSIGHTS

SPONSOR CONTENT FROM MOODY'S ANALYTICS

"Events of this past year have had an unprecedented impact on the world and our organization,” said Deloitte Global CEO Punit Renjen in a statement Wednesday. “From the COVID-19 pandemic to more frequent, extreme climate events, and social upheavals, we are grateful that we've been able to continue to help clients and support our people as we all navigate through this challenging environment. While the past year was difficult and defined by uncertainty, it has shown what can be achieved at speed and scale when businesses, governments and society work together to tackle tough global challenges. This cooperative approach is a model that we must continue to build on."

On the audit and assurance side, Deloitte deployed its global audit platforms, Deloitte Omnia and Deloitte Levvia, to deliver audit services worldwide. The firm’s audit and assurance professionals have also been helping clients and stakeholders address environmental, social and governance reporting needs. The Deloitte Center for ESG Solutions supplied decarbonization, hydrogen, electricity, and other quantitative energy models to support major sustainable energy transformation projects.

Deloitte also released its first ESG report as a firm. Deloitte's FY2021 societal impact investment was $223 million, bringing its five-year investment total to $1.15 billion.

The Deloitte Global Impact Report includes in-depth reporting of the firm’s impact on the environment and on society, as well as a more detailed look at the structures and processes of the organization. In FY2021, Deloitte began reporting against the World Economic Forum's Stakeholder Capitalism Metrics.

Deloitte also issued its first report following the recommendations of the Task Force on Climate Related Financial Disclosures detailing its processes for addressing climate change risks and opportunities in the areas of governance, strategy, risk management, and metrics and targets. The report quantifies climate change impacts in financial terms and also examines risks and opportunities under two different climate scenarios.

Through Deloitte's WorldClimate strategy, it is driving responsible climate choices within the organization and beyond. It is asking its more than 345,000 professionals to take individual and collective climate action alongside clients and communities. In collaboration with the World Wildlife Fund, Deloitte developed a climate learning program for all Deloitte professionals.

As part of the World Economic Forum's Alliance of CEO Climate Leaders, Renjen joined over 70 CEOs in an open letter urging world leaders to support "bold and courageous commitments, policies and actions." Deloitte's greenhouse gas reduction goals were validated by the Science Based Targets initiative. Deloitte also committed to all three Climate Group initiatives supporting 100% renewable electricity, 100% electric vehicles adoption, and energy efficiency and productivity within the organization. During FY2021, Deloitte said it reduced absolute carbon emissions by 41% and carbon emissions per full-time employee by 44% from its base year of FY2019.

The firm also created a Deloitte Center for AI Computing to help with technology consulting.

Deloitte began an initiative with the government of Haryana state in India to help public health infrastructure. The program is being expanded to Africa, Brazil and Southeast Asia.

In the area of diversity, equity and inclusion, Deloitte is pursuing a strategy it calls “ALLIN,” with an emphasis on respect and inclusion. Built upon this foundation are three pillars: working toward gender balance, fostering LGBT+ inclusion, and supporting mental health.

To meet the needs of the firm’s people during the challenges of the pandemic, Deloitte set up a mental health baseline for measuring well-being factors, made a global commitment to mental health within the organization and in society at large, and became a Founding Partner of the Global Business Collaboration for Better Workplace Mental Health, which aims to raise awareness of the importance of mental health in the workplace and facilitate the adoption of best practices that enable employees to thrive in the workplace.

تعزيز المرونة من خلال عمليات الاندماج والاستحواذ

يتطلع التنفيذيون في منطقة الشرق الأوسط وشمال إفريقيا إلى تعزيز مرونتهم من خلال عمليات الاندماج والاستحواذ

معلومات إضافية

-

المحتوى بالإنجليزية

As capital confidence rebounds, corporates in Middle East and North Africa remain nimble and resilient after an unforgettable year.

In brief

Corporate finance and transaction activity in MENA remain buoyant, with the pandemic crisis increasing focus on strategic M&A.

Strategic considerations and transformation programs focus on business resilience and accelerating digitization.

Governments across the region remove red tape to attract foreign direct investment (FDI).

The COVID-19 pandemic crisis has been an unprecedented event, with varying effects on individual countries and sectors in the Middle East and North Africa. Reduced travel, social distancing, remote working and low oil prices have had a disproportionate impact on corporate earnings. Yet, according to the latest results from the EY Global Capital Confidence Barometer, 71% of MENA respondents expect to see revenues return to pre-pandemic levels by 2022 or earlier, while 69% anticipate a return to normalized profitability within the same time frame.

M&A activity driven by government-related entities (GREs) and market consolidations

The Middle East is predominantly a buy-side market given its cash-rich nature. GREs have been a key driver of deal flow over the past 24 months. Largely led by the transformation of national oil companies ARAMCO and ADNOC, and by the investment strategies of ADQ and PIF, GREs contributed to 62% of deal value in 2020.

There has also been a general trend toward increased privatization, especially in the Kingdom of Saudi Arabia (KSA), related to key infrastructure assets, including electricity, aviation, water, customs, staples and housing.

MENA executives find that the current circumstances present a unique time for M&A, with several sectors ripe for consolidation. Domestic private equity (PE) investment has been relatively low in recent years, partly due to challenges in providing reasonable internal rates of return (IRRs) on investments made in the past, and partly as a result of the adverse impact from the news surrounding Abraaj Group. Domestic PE funds are currently more focused on divestments. Nevertheless, there is still a pipeline of interesting mid-market opportunities, largely driven by sellers’ needs to raise capital.

According to the latest results from the EY Global Capital Confidence Barometer, 81% of MENA respondents expect the Middle East to be preferred investment destination that will generate the most growth and opportunities for their company in the next three years.

Strategic and portfolio reviews focus on business resilience and accelerating digital transformation

Accelerated by the pandemic, every MENA respondent surveyed indicates that their company conducted a thorough strategic and portfolio review in 2020. Immediate strategic priorities include cost optimization, capital allocation and understanding the long-term impacts of the pandemic on their business. However, so far, we’ve seen relatively little in the form of restructuring or liquidations. Businesses appear to be managing their costs, while consumers pivoting to staycations have reversed early declines in the travel and tourism industries.

MENA companies are also focusing strategic efforts on digitization. Accelerated by the pandemic, 87% of MENA companies are undertaking substantial business and technology transformations to stay relevant and accelerate growth. The application of technology has made MENA corporates more productive, promoting a gestalt that COVID-19 has triggered the beginning of a widespread digital makeover across sectors.

MENA respondents cite a specific focus on accelerated digitization of customer journeys and business processes as their most important strategic action for growth. MENA executives also are looking for digital solutions that can help them increase customer interactions, and technology and automation that can reduce labor costs and increase scalability to drive increased profit margins.

MENA governments are making the region more attractive for FDI

Governments in the region are enacting regulations that are more friendly to FDIs, both on a corporate level (foreign ownership of assets, easing of capital market norms and simplifying the ability to invest in local capital markets) and a citizen level (elongation of visa periods, citizenship, among other incentives). At the same time, governments, including the United Arab Emirates, are trying to promote liquidity in the capital markets via mandatory listings for certain types of organizations and secondary markets for medium-cap companies.

Growth plans rely on bolt-on acquisitions

In a period of muted organic growth, 84% of the respondents say they plan to invest in bolt-on acquisitions and 94% of the respondents expect greater competition for assets; much of the competition is expected to be from private capital in MENA.

The EY Global Capital Confidence Barometer confirms that even in the worst crisis known to humankind, MENA corporates remained largely resilient and nimble. They are capitalizing on the new normal and successfully pivoting their businesses to an exceptional intersection of the physical and digital worlds.